Trading in the forex market for beginners can be quite tricky. This is due to the fact that beginners in the market generally have high expectations. However, when it comes to trading, many of the basic principles are the same whether we’re talking about forex trading or share trading for beginners.

When starting out as an HFX trader or a forex trader in general, it is important to research properly before delving in. Having a good knowledge of the advantages and disadvantages of HFX trading will enable you to choose the right strategies and trade better.

In this article, we will focus explore all that you need to know about HFX trading as a beginner. From basic knowledge to best methods for executing a trade as an HFX trader.

What you will read in this Post

(Risk warning: You capital can be at risk)

What is HFX trading?

HFX trading (Forex trading) is a term used by individuals (Forex Trader) who participate in the active exchange of foreign currencies, frequently for the aim of monetary advantage or benefit.

Traders attempting to purchase or sell a currency with the intention of benefitting from the currency’s price movement, or hedgers looking to safeguard their accounts in the case of a negative move against their own currency positions, are examples of this.

An individual trader using a retail platform, a bank trader using an institutional platform, or hedgers who are either managing their own risk or outsourcing that role to a bank or money manager to manage the risk for them are all examples of forex traders’.

See my full video guide:

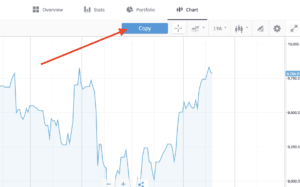

Before we start: Choose the best HFX trading platforms:

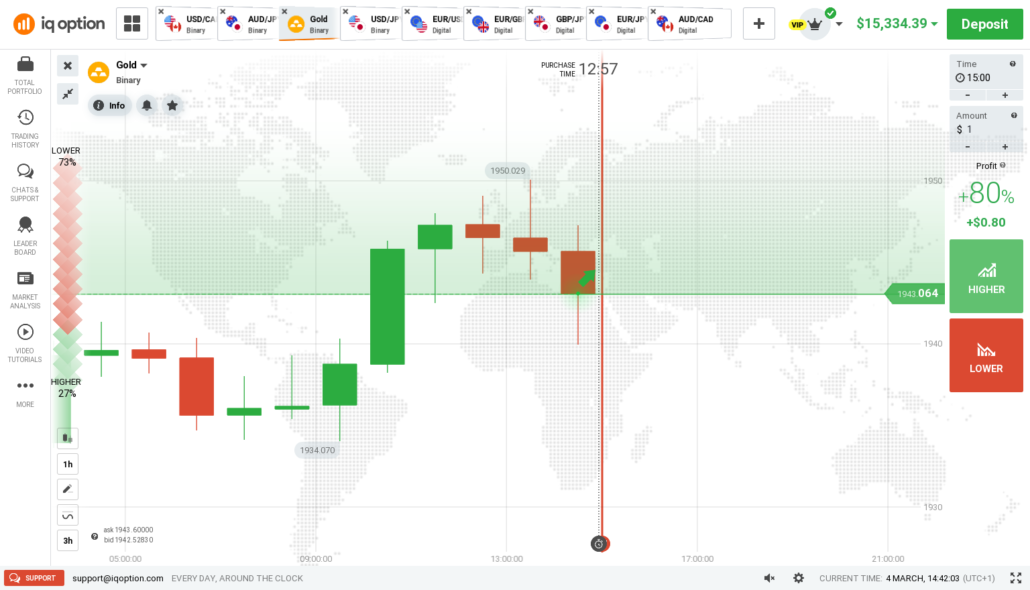

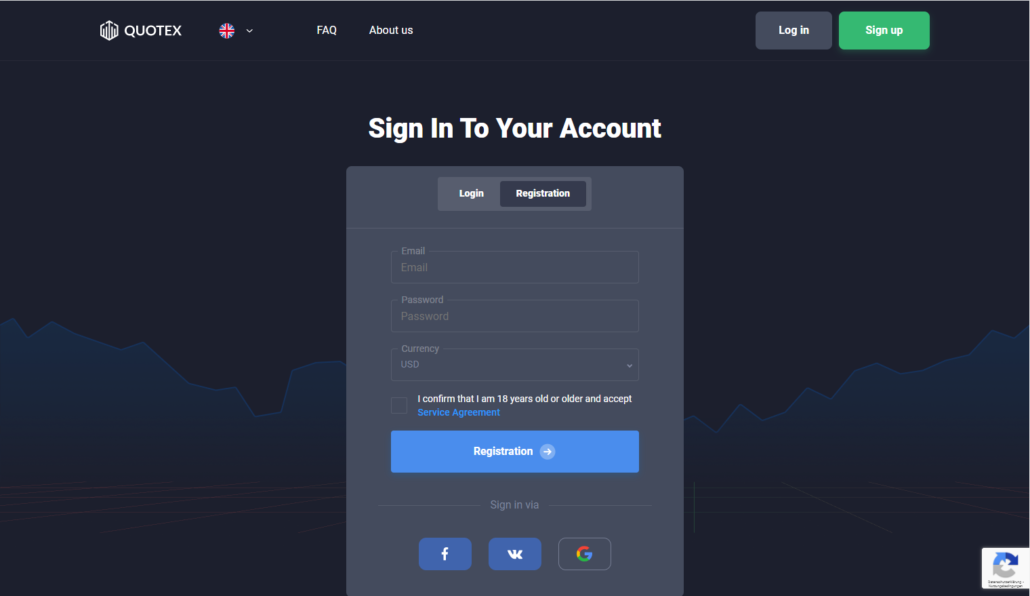

When you want to get access to HFX trading, you will need the right broker and platform. Not every broker out there offers these kinds of short-term contracts (digital option).

See the 3 best here:

(Risk warning: Trading is risky)

(Risk warning: Trading is risky)

(Risk warning: Your capital might be at risk)

What are the pros and cons of HFX trading?

Forex trading, like many other trading activities, may have both pros and cons for traders. Newbies in the trading market considering venturing into forex trading should examine the benefits and drawbacks to decide whether it is an appealing and acceptable market for them.

- Availability

- Use of leverage

- Possibility of quick returns

- Simple and easy short trade

- Availability of funds

- Practical method

- There’s a lower chance of price manipulation from inside

- Commissions are reduced

- Basic tax law

- Computerized

- Instability

- Challenges for small businesses

- Less strict regulatory measures

- Relatively Low Marginal Returns

Below are the listed pros and cons of HFX trading and we will explain further in this article.

Pros of HFX trading

These are the advantages of Forex trading:

1. Availability

The forex market is one of the best obtainable markets for new traders. Dealers can open a forex account in 1 to 3 days and start trading with only £50. Most brokers allow trade online, and electronic trading platforms provide users with actual market pricing, information, tool, price charts, and strategies.

Secondly, since the forex market is open five days a week (not on weekend), 24 hours a day, it is easier for traders to schedule forex trading into daily schedules than another kind of tradings.

2. Use of leverage

The ability to trade with leverage can mean the distinction existing between little and massive profits. In HFX trade, there are more funds available for leverage than in other marketplaces. Traders are able to get a margin that provides leverage of 100/1 even more for start-up cash placed in trading depending on where they operate.

3. Possibility of quick returns

The FX market moves quickly and has a lot of volatility. These qualities, combined with forex traders’ often larger leverage, imply that the forex may offer faster profits than other markets, where traders may have to wait for the long term for natural asset value growth and profits from assets traded. This is an advantage in the HFX market, as the rapidity reduces the forex trader’s investment risk.

4. Simple and easy short trade

Short and simple selling in some markets sometimes includes acquiring assets and risking being bailed out of a single stock by the borrowers, but shorting currencies on the currency market are much easier.

Currencies are sold and bought in pairs, which implies that if a trader purchases one, they must sell another. Traders who bet on a currency’s depreciation need just sell it and buy another pair with it, and with little or no loan required.

5. Availability of funds

The FX market is the largest marketplace internationally by number. This means that, especially in big countries, there is always more than enough turnover for trading. Traders that use the trading desk model at forex dealers are typically provided with enough liquidity to trade with.

(Risk warning: You capital can be at risk)

6. Practical method

Trading planning works well in forex trading. While stock and credit traders may need to dig a little deeper into the basics and financial wellbeing of issuers to verify that their assets will return profits, forex traders can easily profit through a simple examination of price movements.

Despite basic research, which involves extensive background information on an investor’s financial health, practical analysis is always based on price histories and trends that reveal market perceptions of demand and supply, as well as attitudes toward that investment.

7. There’s a lower chance of price manipulation from inside

Personal information stored by stakeholders and insiders of those investments can often have a huge impact on the market, credit, and even futures markets. The currency market, on the other hand, is under control.

8. Fees and commissions are reduced

Trading in markets, stocks, investment companies, as well as other derivatives is usually subject to outrageous commissions and hidden costs, which can make trading more costly than anticipated. These charges are avoided when individuals trade currencies on the forex market.

The deal spread, which is the disparity between both the ask (selling) and bid (buying) prices openly displayed by brokers on a real-time basis, is most often the only factor of forex trading costs which is another feature of forex trading that makes it clear.

9. Basic tax law

In cases when traders in other marketplaces may be required to keep detailed records of their long and short-term trading activity for tax purposes, forex traders are usually subjected to more simple tax laws that make tax work easy.

10. Computerized

Online trading algorithms are well-suited to forex trading. Fx traders can easily schedule trades in anticipation of making an offer by setting entry, limiting prices, and stop-loss. Furthermore, forex traders can teach the platform to trade on specific market volatility or market conditions.

(Risk warning: You capital can be at risk)

Cons of HFX trading

These are the disadvantages of HFX trading.

1. Instability

Uncertainty of market price can be seen in any market at any time, and the Forex market is no exception. Forex traders seeking short-term returns may be faced with unexpectedly high instability, rendering their forex trading tactics unprofitable.

2. Challenges for small businesses

On a daily basis, more than $4 trillion is exchanged on the global FX market, with important players such as banking institutions, fund managers, and other huge financial institutions still doing the majority of the trading.

These organizations can have a structural edge both setting prices and influencing price fluctuations in the market because of the volume of their trade and their better access to information and technology.

This is true for most trades, although it is particularly evident in the FX market. To ensure that their currency transactions are beneficial, traders must keep up with the newest fast-moving market changes.

3. Less strict regulatory measures

The HFX market is an over-the-counter market, which means traders aren’t executed on a centralized exchange and regulatory monitoring is frequently lacking. As a result, traders may need to conduct “careful research” on their firm’s reputation and trading methods prior to opening an account.

In addition, regardless of what country they trade-in, they may have fewer rights of appeal if they think the brokers like Quotex or Olymp Trade have not treated them fairly which of the main downsides of forex is the lack of regulation.

4. Relatively Low Marginal Returns

Stocks usually pay dividends and interest on a routine basis, which can increase the asset’s long-term worth. However, the primary goal of trading forex is to benefit from the growth of each of the currencies in a specific currency pair.

Daily forex holdings, on the other hand, might yield or make payments. This is dependent on the interest rate differentials between the nations issuing the currencies sold or bought. This type of interest is known as “rollover” interest.

(Risk warning: You capital can be at risk)

How long does it take to learn HFX trade?

There is no limit to continually learning HFX trade because the forex market is a fast-moving market and you must learn something new every day.

The most crucial aspect is to develop your own plan. Make an effort to come up with creative approaches. This is going to take a long time however, every minute is valuable.

After you’ve studied, try out your approaches on a practice account. This will assist you in determining whether or not the methods are working.

Bear in mind, this will be a lengthy process. It can take as long as 2-3 months, or even longer which isn’t uncommon, there is no such thing as a waste of time,

How does HFX trading work?

HFX trade is easy but at the same time tricky, you need to know how the forex market operates. For instance, Imagine you expected the price of a stock to climb by a dollar for 10 seconds instead it dropped back down — a type of instability that occurs numerous times on financial markets every day.

Assuming you are able to purchase 1 share of stock within a second before the stock rises, and then resell them within seconds later. In seconds, you’d make times 10 the initial investment. That is how high-frequency trading works in a nutshell.

The demo account is available and packed with educational tools to help you navigate your way through the market system.

Why use high-frequency Forex?

High-frequency (HFX) trading is one aspect of a bigger trend in the foreign exchange market, fueled by advancements in information technology and the development of electronic trading.

In terms of Forex trading, HFX trading has helped traders to recognize successful trading opportunities in the marketplace which is one of the distinguishing traits that sets them apart from other algo decision-makers.

(Risk warning: You capital can be at risk)

Is Binary trading the same as HFX trading?

Binary and forex trading have similarities but they are different. Binary options are dangerous deals in which the trader forecasts whether an asset (or, in the case of HFX trading, a currency) will rise or fall over a given period of time.

The trader can easily see how much money they will make if the predictions come true. If the theory is right, you get all of your investment back plus the return, but if it doesn’t, you forfeit all of the money you risked.

Binary options and HFX trading may both be done online and with small amounts of money. The difference between them is the profit margin you can make over time. To make big gains with binary options, you must make more accurate predictions.

HFX trading terminologies

The HFX marketplace is filled with unique terms, abbreviations, and words that often cause a major barrier to traders, especially beginners.

When using new platforms like Meta Trader 4, Meta Trader 5, and various other platforms, getting accustomed to trading can be tricky, hence, it necessary to understand those tricky materials or unique terms.

This article will help you understand some of the core terms, in order to build your forex trading knowledge.

- Leverage

In general, leverage is money borrowed from a brokerage account. Leveraged trading allows a trader to open an account with a huge contract size for a reduced cost. High leveraged trade is a good way to trade your favorite Forex pairs, Cryptocurrency, and other assets without having to put up a lot of money.

- Swissy/Currency pair

In the trading movement, there are more than 120 accepted currencies, which are used in severe countries. We can guess the profitability of a dollar as traders by employing a variety of research and data to forecast how that particular currency will move in the FX marketplace.

The strategy we adopt while trading currencies is through Forex trading, thus focusing mostly on the profitability of a particular currency over another. Swissy/ currency pairs are categorized into three main types.

- Major Pairs

These are just the 8 top frequent sets/ pairs, with each USD as the exchange rate or base currency and one of the listed below currencies as the cross money: CAD, GBP, JPY, NZD, EUR, CHF, AUD.

- Exotics

These are less known countries that can be quite unstable and are widely exotic currencies. Hungarian Forint, Polish Zloty, and the South African Rand are one of them.

- Cross pairs

These pairs are currencies that do not use the US Dollar as the base or counter currency. It is considered to be riskier than Major Pairs.

- Ask/ Bid Price

A broker’s bid price is the amount he or she is willing to pay to purchase a currency pair while a broker’s ask price is the price at which he or she will purchase a currency pair.

- PIP

PIP is the abbreviation of Percentage In Point. PIP is the tiniest change in a foreign pair’s currency rate. The PIP is the fourth digit on a foreign pair’s price quote. It’s a metric for determining worth.

- Margin

Margin is the first investment a trader needs to place in order to start a trade. Margin allows a user to engage in more aggressive trading techniques. While investing on margins, the trader only needs to produce a part of the true worth of the stake to open a transaction. It also enables aggressive trading, but be mindful that both profits and losses are increased.

(Risk warning: You capital can be at risk)

Step to open an HFX trading account

The very first step you’ll do is to open a forex trading account. To create a profile, you’ll need to input personal data, including the following:

- Name

- Phone Number

- Email Address

- Type of account currency

- Date of birth

- Nationality

- Password for your trading account

- Tax Identification Number (TIN)

- Status of employment

These are just the basic requirements for opening an HFX account, they are easy to navigate, and in a few minutes, you have an account.

(Risk warning: You capital can be at risk)

How can I choose the best HFX platform?

When trying to decide on which High-frequency Forex (HFX) trading platform is best for your needs, there are also some points to take into consideration.

Also because the brokerage you choose has a significant and measurable influence on the effectiveness of your trading style, it is critical that you consider a range of criteria prior to settling on one. There are numerous elements that should be taken into account but mention a few.

- Safety and regulation

- Demo account

- Mode of payment

- Analysis and research

- Spread

Are HFX brokers necessary in HFX trading?

Absolutely, an HFX broker like Quotex or IQ Option is needed when trading foreign currencies. HFX brokers make trading easy for traders and enable them to have time for their engagement. In addition, there are severe brokers with top rankings that have made trading for beginners.

Conclusion

HFX trading platforms offer a distinctive service: various assets that you could trade on them aren’t easily accessible on other platforms. Before investing through an HFX broker, there are a few key things to note, which were also outlined. These include things like safety and regulation, fees and assets, as well as more basic marketplace requirements.

High-Frequency Forex (HFX) trade has a lot embedded in it, including unavoidable risk, all you have to do is to create a trading strategy that works for you. Continually learn more daily, the forex market changes faster than we think. We hope this article has been helpful.

(Risk warning: You capital can be at risk)

Bergmann

says:Hi, I am interested in Binary Option.

Can you personally recommend a Binary Option Broker that is

Regulated

Accept retail Trader with a minimum capital ca $500

Europe Regulated

Or a Binary Option Broker that you personally use…

Hope to hear from you.

Vh

Bergmann